As in any business, it’s important to know where your funds came from (or will come from), where you’re keeping them, and how they have been (or will be) spent. In this section we’ll look at the steps needed to:

- Track & Report Cash Flow

- Accounting software

- Standard reports

- Develop a Budget

Track & Report Cash Flow

Tracking Your Funds - Record keeping

While record keeping for larger organizations can get complicated and require more sophisticated accounting procedures, smaller organizations like ASPEN chapters can effectively track funds with a fairly simple set of procedures and accounts. At its most fundamental level, your accounting system needs to tell you where funds came from, where they are held, how they have been spent, and why they are spent.

Every transaction (receipts, expenditures, and funds transfers) needs to be recorded, ideally the day of the transaction or within a couple days at most. The longer the time in between, the greater the likelihood that some detail of the transaction may be forgotten and incorrectly entered.

Transactions can be recorded in a number of ways including desktop or online accounting software, spreadsheets, and now many banks offer online accounting programs as well.

Accounting Software

There are a number of easy-to-use software programs available to track and report financial activity. We recommend a program like Quicken Home & Business or Quickbooks. The latter offers more professional accounting features and a wider set of reporting options. You might also consider Quickbooks Online, which allows multiple users to view accounting data and reports at any time in real time.

Products like Quicken and Quickbooks offer a number of important advantages over other options:

- They offer a very simple, intuitive process that can be easily set up and used in less than half an hour.

- They are very inexpensive. Quicken starts as low as $39.99, though we recommend at least Quicken Deluxe ($69.99) or better still, Quicken Home & Business ($109.99).

- They have a large user base and long history ensuring that just about every problem has been seen and solved.

- They include a full set of reports that can be easily customized and shared.

- They will print checks with just about any printer.

- They also include an easy link to your bank account so transactions and balances can be uploaded/downloaded with a single click.

- The license and data file can easily be transferred from one location to another as the new treasurer steps in.

Click the Quicken or Quickbooks links above to see all the details as well as a very short video showing how this software works.

Though more expensive, an online accounting software license may be the best option in that data is automatically backed up and also accessible to several association officers thus ensuring transparency and reducing the risk of all accounting being in the hands of a single individual.

Spreadsheets

Spreadsheet programs like Microsoft Excel can be set up to track funds, however, the user will need some skill with the software, and a fair amount of time will be necessary to build the transaction templates and reports as well. You might also consider using Google Docs for its spreadsheet functionality and ability to share.

There are a number of free accounting templates available from Microsoft and other sources as well. Here are a few examples:

Each can be customized, but will require some programming to link these sheets and statements together. Like the accounting software noted above, the software license and data file can be transferred from one individual to the next with little difficulty.

Online Banking

Most banks now offer online banking and include some level of bill pay and reporting. Check with your bank for details. We recommend online bill pay be disabled, however, because there are no signature requirements (i.e., whoever has access can pay a bill whether approved or not). For security purposes, we strongly recommend that the chapter should have two people at minimum involved in the process so the individual writing the check is not the signer. This simple practice is endorsed by the nonprofit sector because it protects the board, the chapter, and the officers with financial responsibility while reducing the likelihood of mistakes and theft. Consider breaking down the process as such:

- The treasurer (or accounts payable position) verifies the invoices and bills to be paid for accuracy by comparing documentation and checking with the person responsible for the purchase and writes the check.

- The unsigned check and the supporting documentation is given to the check signer who may be the board president or designated officer who reviews and signs.

Tracking Your Funds - Reporting

Balance Sheet – The balance sheet indicates what you own (assets), what you owe (liabilities), and the difference between the two (equity). For most chapters, assets will consist of a checking and savings account and perhaps a money market fund. There should be few, if any, liabilities, given that the chapter typically runs on a cash, rather than accrual, accounting basis.

The balance sheet provides a snapshot of the funds available for future activities. A comparative balance sheet (the current year versus the previous year or month) helps you determine if your fund balance is going in the right direction. A typical balance sheet might look like this:

Assets

Checking 765.25

Savings 1,802.32

Total Assets 2,565.57

Liabilities

Accounts Payable (unpaid bill) 128.54

Total Liabilities 128.54

Equity (Assets minus Liabilities) 2,436.46

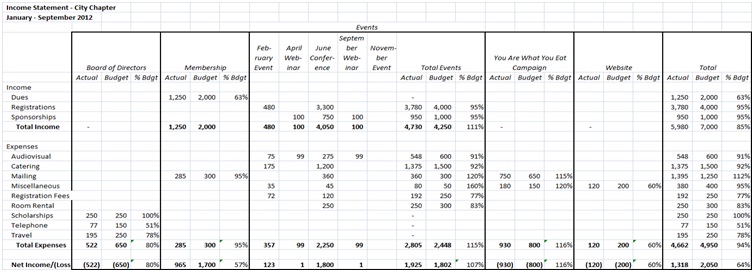

Income Statement – The income statement indicates where funds came from, how they have been spent, and why they were spent. Ideally the income statement is organized by function (how funds are generated/spent) and by program (why funds are generated/spent). Here’s a simple example.

The above statement allows chapter leaders to easily see which activities generate positive income (revenue centers), which generate a loss (cost centers), and which are revenue neutral.

Depending on the accounting software you select, you’ll usually want to use the “account” or “category” field to track functions (dues, registrations, audiovisual, catering, etc.) and use the “customer/job” or “memo/tag” fields to track programs (Board, Membership, Events, etc.). Regardless, you want to start by thinking of how you want to report the information out, before you start putting transactions into the system.

Protecting Your Funds – Checks and Balances

While instances of theft and fraud are very rare, everyone sleeps better, especially those who handle the funds, when a transparent set of checks and balances are in place to assure the chapter’s funds go where they’re supposed to go. To achieve that peace of mind, here are a few relatively simple policies and procedures.

- Have two people involved in the process so the individual writing the check is not the signer (e.g., the president signs checks that are prepared and written by the treasurer).

- Checks over a specified amount (many view this as $1,000, but it will depend on the size and scope of your finances; what is risky for a small group may be customary for a larger group)require two signatures, neither of whom being the person who cuts the checks.

- The bank statements are reconciled monthly and a copy of the statement and reconciliation are provided to at least two officers other than the individual who does the reconciliation.

- Online banking read-only access is available to the above officers so they can confirm that the reports match the online balances.

- The full board receives a copy of the balance sheet and income statement monthly or quarterly.

There are additional steps that could be taken (e.g., independent review or formal audit), however, they are probably not justified at this time for most chapters given the high cost and effort required to complete.

Develop a Budget

Whether you’re running a household or small business, it’s always in your interest to put together a budget. The budget serves as a benchmark against which to assess financial progress on a periodic basis. The software programs identified above provide a budgeting function to help you.

Ideally the budget is based on a realistic combination of history (prior year’s income and expense) and goals for the coming year. Those goals should be defined in your annual plan (see Annual Planning Guide). The budget in the sample income statement above will give you an idea of how your chapter’s budget might be constructed.

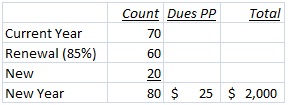

Each of the budget items is based on an assumption about the level and cost of each activity. For example, membership income could be estimated as follows:

Historically, you may know that you typically renew 80% of current members and hope to recruit 20 new members. This should align with the membership goal defined in your annual plan (e.g., in this case a 15% increase).

Of course there will also be expenses associated with this effort, including the cost of promotion (mailings, brochures, etc.) that should be identified in the budget as well.

The budget and any expenditure over budget should be approved by the board. Bottom line, the budget offers an ongoing benchmark against which performance can be measured, and, most importantly, adjusted when things run differently than planned.